Icon and its affiliates do not provide tax or legal advice. Apex Clearing Corporation, a third-party SEC registered broker-dealer and member FINRA/ SIPC, provides custody and clearing services for Icon Financial. Icon reserves the right to restrict or revoke any and all offers at any time.īefore opening an investment advisory account, you should review Icon Financials (Form ADV 2 Brochure) which includes a description of certain risks, conflicts, and fees associated with participating in the Icon platform. Certain investments are not suitable for all investors. The content on this website is for informational purposes only and does not constitute a complete description of Icon’s investment advisory services. Account holdings are for illustrative purposes only and are not investment recommendations. Any historical returns, expected returns, or probability projections are hypothetical in nature, and may not reflect actual future performance.

Past performance is no guarantee of future results.

Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Investment advisory services are provided by Icon Financial Services LLC (“Icon Financial”) through its online platform and are available only to residents of the United States over 18 years old. Icon Financial Services LLC (“Icon Financial”) is an SEC registered investment advisor. By using this website, you accept our Privacy Policy. This website is operated and maintained by The Icon Savings Corporation (together with its subsidiaries and affiliates, “Icon”).

#Self employed contractor expenses how to#

All of these forms, and additional information on how to pay self-employment taxes, can be found on the Self-Employed Individuals Tax Center on the IRS website. To file annually, you must complete Form 1040-C. You can also securely pay these taxes over the Internet through the Electronic Federal Tax Payment System (EFTPS). You can also use this form to file your taxes for income from self-employment, and it has vouchers you can use to send money to the IRS. IRS Form 1040-ES can tell you if you need to file quarterly, as well as the quarterly due dates that must be met throughout the year to avoid penalties. Some self-employed individuals have to pay these taxes in quarterly installments over the course of the year, while others file just once a year.

#Self employed contractor expenses professional#

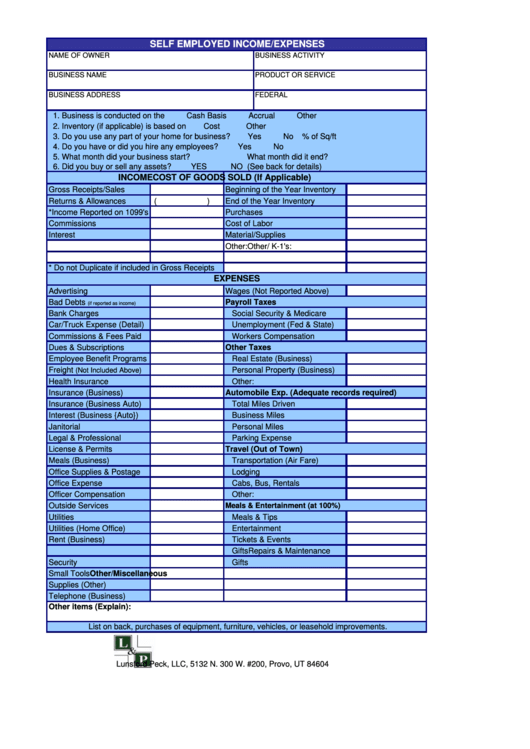

In addition to business expenses, self-employed people can also receive deductions for things like health insurance, retirement accounts, and professional services such as accountants and lawyers. They can include supplies, travel, office space, and other expenses. Make sure to keep track of your business expenses, since these can be deducted from your income.īusiness expenses are directly tied to the operation of your business. Unlike Social Security, there is no income cap to Medicare taxes, so you’ll pay on all money you make, no matter how much it is. Self-employed individuals also have to pay the Medicare tax rate for both employer and employee. For example, if you make $140,000 in a year, you pay only 12.4% of $127,200 ($15,772.80), with the remaining $12,800 untaxed by Social Security. Social Security taxes apply only to the first $127,200 of income, so you don’t have to pay these taxes on any money earned above that level. So if you make $40,000, you’ll pay $4,960 in Social Security taxes. Social Security taxes are 6.2% for both the employer and the employee, but since self-employed people are actually both, their Social Security tax rate is effectively 12.4%. But since you are self-employed, you’ll need to pay for 100% of the cost yourself. Employers take these taxes out of employee earnings as part of payroll and split the cost with the employee. In addition to paying federal and state income taxes, independent contractors, the self-employed, freelancers, and anyone who receives a 1099 are also responsible for paying self-employment income taxes, i.e, Social Security and Medicare taxes. Here’s what you need to know about paying income taxes as an independent contractor.

Congratulations! You set up your business, you attracted clients, you completed the work, and you got paid.

0 kommentar(er)

0 kommentar(er)